Is/are the resources from which a company expects to gain some future benefit ✅ Tốt

Thủ Thuật về Is/are the resources from which a company expects to gain some future benefit Mới Nhất

Lê Hoàng Hưng đang tìm kiếm từ khóa Is/are the resources from which a company expects to gain some future benefit được Cập Nhật vào lúc : 2022-12-17 23:40:13 . Với phương châm chia sẻ Mẹo Hướng dẫn trong nội dung bài viết một cách Chi Tiết 2022. Nếu sau khi đọc tài liệu vẫn ko hiểu thì hoàn toàn có thể lại Comment ở cuối bài để Ad lý giải và hướng dẫn lại nha.This guide includes everything you need to understand and begin fixed-asset accounting. Our accounting experts provide standard journal entries, examples, guidance and helpful visuals.

Nội dung chính Show- What Is a Fixed Asset?What Is an Asset?List of Fixed Assets in AccountingExamples of Fixed AssetsClassification of Fixed Assets in AccountingWhat’s the Difference Between Total Assets and Net Assets?Net Assets FormulaTotal Assets FormulaDetermining Service Life of an AssetWhat Is Fixed-Asset Accounting?The Fixed-Asset Accounting CycleThe Fixed-Asset LifecycleAcquisition: Accounting for Purchase of Fixed AssetsAsset SplitsNon-Monetary Transfer of a Fixed AssetAccounting for Depreciation of Fixed AssetsJournal Entries for Fixed-Asset DepreciationSalvage Value in Depreciation CalculationsStraight-Line DepreciationAccelerated or Sum of Remaining Years DepreciationUnits of Production DepreciationDouble Declining Balance DepreciationDepreciation and Tax DeductionsWhat Is the Accounting Treatment for the Revaluation of Fixed Assets?Revaluation: Valuation Models for Fixed AssetsPerforming Impairment TestingImpairment Loss Journal EntryAccounting for Disposal of Fixed AssetsJournal Entry for Gain on DisposalJournal Entry for Loss on DisposalFixed-Asset Accounting Best PracticesSpecial Cases in Fixed-Asset Accounting and How to Handle ThemWhen to Record Software and Associated Costs as Fixed AssetsHandling Leasing Fixed AssetsHow to Deal with Fixed-Asset Accounting for an Insurance ClaimFull Reimbursement on an Insurance ClaimNo Payout from Insurance CompanyGain or LossFixed-Asset Accounting FAQWhat Is a Fixed-Asset Accountant?What Is Component Accounting for Fixed Assets?How Do You Handle Accounting for Deposits on Fixed Assets?How Do You Handle Accounting for Replacing Assets?What Are Fixed-Asset Clearing Accounts?NetSuite’s Fixed-Asset Accounting System for Improved Asset VisibilityAre items owned by a business that will provide future benefits?Which of the following terms refers to any economic resource that is expected to benefit a firm or individual who owns it?What are asset examples?Is cash an asset or equity?

In This Article:

What Is a Fixed Asset?

A fixed asset is a tangible piece of property, plant or equipment (PP&E); a fixed asset is also known as a non-current asset. An asset is fixed because it is an item that a business will not consume, sell or convert to cash within an accounting calendar year.

The term fixed, however, does not refer to the physicality of an asset. Some companies move fixed assets regularly for business purposes. Recording fixed-asset transactions helps create valuations and aids in financial reporting, which can be crucial to capital-intensive projects. Most businesses own least some fixed assets.

What Is an Asset?

An asset is any resource that you own or manage with the expectation that it will yield continuing benefits or cash flows. An asset is also a resource the value of which you can dependably measure. Individuals, companies and governments can hold assets. Entities record their purchase of a fixed asset on the balance sheet, Asset purchases used to be noted on a sources and uses of funds statement, which is now called a cash flow statement.

Fixed assets differ from inventory in that inventory exists for the purpose of consumption. Inventory includes items such as raw materials and supplies for manufacturing, finished goods for sale and supplies for maintenance, repair and operations.

List of Fixed Assets in Accounting

In accounting records, each fixed asset receives an account. The following list includes examples of fixed assets.

Examples of Fixed Assets

- Buildings and Facilities:

Fixed assets include existing buildings and facilities that are under construction. Anything under construction exists in an accumulation account (for example, Construction-in-Process) until the work is complete. Upon completion, an accountant will move the asset to the appropriate fixed-asset account.Computer Equipment:

These assets include servers, laptops, desktops, iPads and so on.Computer Software:

Software fixed assets focus on enterprise packages and platforms. Cloud-based applications are treated like software fixed assets for internal use, described later in this article.Furniture, Fixtures and Fittings:

Furniture includes office equipment, desks, cupboards and conference tables. Fixtures include built-in items that you can’t easily remove, such as fireplaces. Fittings (known as chattels in the UK and movables in Scotland) include removable items such as mirrors, lights and art.LandLeasehold Improvements:

These fixed assets are any additions and upgrades you make to leased assets or rental property. Such assets include built-in cabinets, interior walls, ceilings and any electrical and plumbing upgrades.Heavy Machinery and EquipmentTools:

Tools used in the business may be fixed assets depending on their financial basis and the value threshold of the company. For example, you would expense a $12 hammer, but a $1,500 insulated tool set or high-end drill bit set may be a fixed asset.Vehicles:

These assets include cars, trucks, forklifts and more.

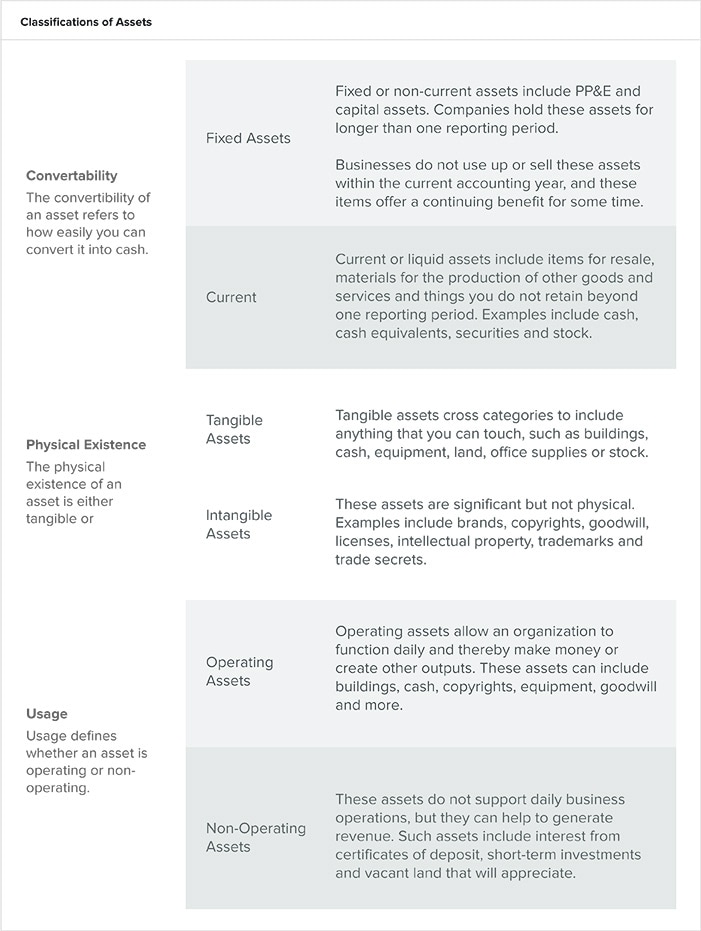

Classification of Fixed Assets in Accounting

Companies classify their assets into recognisable types, which are essential to understanding the net working capital and solvency of an organisation. Accountants categorise assets using the following guidelines:

- Properties:

Assets are a resource and represent ownership and economic value. An owner can exchange an asset for its commercial value or use it as a resource to create more wealth or benefits.Classifications:

You can also distinguish assets by their physicality (physical existence), convertibility (level of ease with which you can convert them to cash) and their business usage.

What’s the Difference Between Total Assets and Net Assets?

Net worth or net assets describe the value of an entity. The calculation for net assets is assets minus liabilities. Determine total assets by adding total liabilities to owner’s equity.

Net Assets Formula

Net Assets = Total Assets – Total Liabilities

Total Assets Formula

Total Assets = Total Liabilities + Owner’s Equity

Determining Service Life of an Asset

For accounting purposes, an asset’s service life may not match its item life. The service life of an asset is an accounting and management estimate of the useful life of an object. Base the service life estimate on the following:

- General knowledge of how long similar items lastWhether the asset is new or usedWhether you use the asset frequently or seldomHistory of obsolescence for such itemsService patterns for an industry or an individual business

Some assets return value after their service life, such as with car trade-ins, while some companies use other assets until they are worthless.

What Is Fixed-Asset Accounting?

Fixed-asset accounting records all financial activities related to fixed assets. The practice details the lifecycle of an asset, such as purchase, depreciation, audits, revaluation, impairment and disposal. In a company’s books, each asset has an account, where all the financial activities related to fixed asset are recorded.

“Fixed-asset accounting is about understanding how to properly account for the investments you make as a business and about understanding what would count as a capitalised cost,”

explains Riley Adams, a licensed CPA in the state of Louisiana working as a senior financial analyst for Google in the San Francisco Bay Area. He writes the personal finance blog Young and the Invested, which is dedicated to helping young professionals find financial independence and explore entrepreneurship.

“The capitalised cost of an asset is depreciated over time with its use. Fixed-asset accounting is about distinguishing between what costs can be capitalised and what should be immediately expensed in the year the asset goes into service,” Adams adds.

Accounting regulations and standards are followed to ensure the uniformity of an organisation’s financial statements. These procedures include documenting financial records, calculating revenue, estimating fixed-asset valuations and complying with tax laws. Generally Accepted Accounting Procedures (GAAP) form the standard used by the United States Securities and Exchange Commission (SEC). The International Financial Reporting Standards (IFRS), headquartered in London, with the International Accounting Standards Board (IASB) as its standards-forming board, provides common accounting practices for businesses worldwide.

“Most businesses in the U.S. use GAAP. Public companies that file quarterly and annual reports to the SEC must present their financial statements in accordance with GAAP,” Adams says.

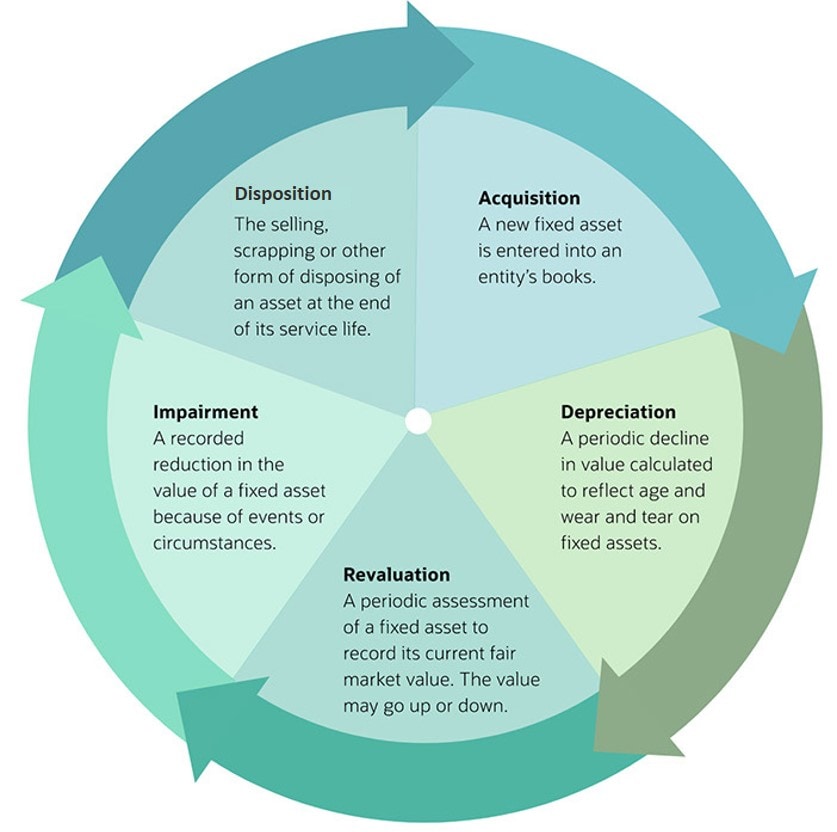

The Fixed-Asset Accounting Cycle

Each fixed asset has a lifecycle that includes least three of these stages: purchase, depreciation, revaluation, impairment and disposal.

The Fixed-Asset Lifecycle

These journal entries (see examples below) cover the transactions associated with the fixed-asset lifecycle:

- Acquisition:

Enter the total purchase cost, including any costs to ship, install or costs that ensure the safe and serviceable function of an asset. The journal entry documents whether you purchase the asset outright, through instalments or via an exchange.Depreciation:

In this entry, you record periodic depreciation or a decline in net book value for tangible assets and amortisation for intangible assets.Revaluation:

These types of entries reflect the current fair market value of a fixed asset. You’ll need to make a series of accounting changes to determine if there is a gain or loss from revaluation.Impairment:

Also called writing down, represents the period during which the market value of an asset is less than the valuation entered on an organisation’s balance sheet.Disposition:

At the end of an asset’s useful life, a company may dispose of an asset by selling, trading or scrapping it. In this phase, you eliminate the assets from the accounting records. You may end up recording a gain or loss on the asset disposal transaction during that financial period.

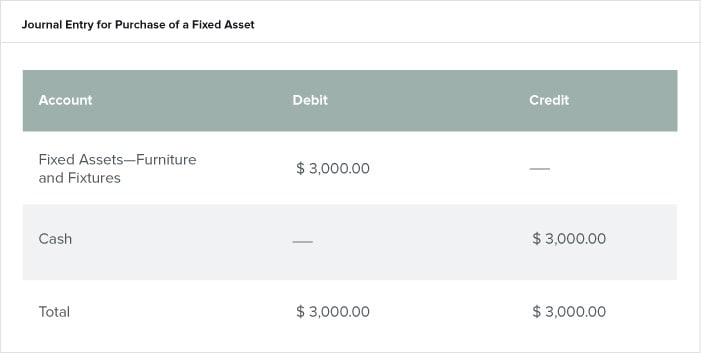

Acquisition: Accounting for Purchase of Fixed Assets

To record the purchase of a fixed asset, debit the asset account for the purchase price, and credit the cash account for the same amount. For example, a temporary staffing agency purchased $3,000 worth of furniture. When the furniture arrives, the accountant debits the fixed assets account and credits the cash account to pay for the furniture.

For assets bought on instalments, include the interest rate. Gauge assets exchanged for other assets fair market value. If you can’t measure the value of an exchanged asset, carry over the value of the original asset.

For practical purposes, you may treat individual items in an asset category as one asset. Examples include office chairs or laptops. To be considered one fixed asset, items must share an asset group, acquisition date and an acquisition cost.

Asset Splits

You can split one fixed asset into multiple assets. Over time, you may separately transfer or dispose of each item. Then, split the asset on the books and record it as an asset split. Splitting creates a new asset but retains the ID of the original asset.

You can split assets by quantity or by book value. Suppose you buy four tablets for a total of $2,000. If their useful life is three years, using straight-line depreciation, the monthly depreciation for the complete asset is $55.55. Six months later, someone drops a tablet on the concrete stairwell and the company must dispose of it. The accumulated depreciation for the whole is $333.33 and the net value is $1666.67. From this transaction, split the asset into two.

Now you have two assets: the original with three tablets and a second asset with one tablet. Since this breakage reduced the original quantity from four items to three, the ratio is 75% (3/4 *100).

Multiply the original cost by the ratio

then by the number of months the equipment is meant to be in service

Then multiply the depreciation per month by the number of months gone by for the accumulated depreciation

Subtract this accumulated depreciation from the original cost for the net value

When you split the asset, the original asset retains its ID.

The new asset is unique, gets a new ID and represents 25% of the original asset. The asset is one unit and gains the accumulated depreciation of $83.33, and the net value is $416.67.

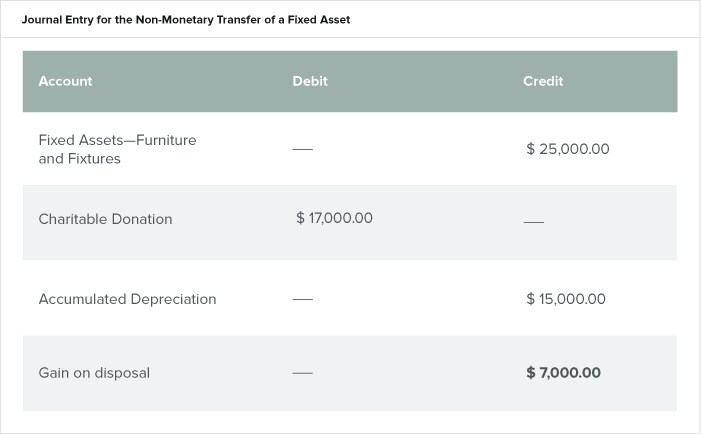

Non-Monetary Transfer of a Fixed Asset

Non-monetary transactions usually involve real estate swaps or asset transfers, as when someone donates an asset to a nonprofit. Suppose a consulting firm is moving to a new office and decides to donate its old desks to a charity. The original cost was $25,000. The accumulated depreciation is $15,000. The book value, therefore, is $10,000. The fair market value is calculated $17,000.

The journal entry for the books looks like this:

Accounting for Depreciation of Fixed Assets

Enter depreciation on the books for the total sum of assets or by asset type. The amount of accumulated depreciation plays a role in calculating any loss or gain the disposal of the asset.

There are four types of depreciation:

- Straight Line:

This option spreads the depreciation evenly over the useful life of an asset.Accelerated or Sum of Remaining Years:

This method writes off more of the cost in the early years and less in the later years.Units of Production:

Depreciation by units of production writes off an asset according to how much that asset produces.Double Declining Balance:

This method accounts for the expense of a longer-lived asset that quickly loses its value or becomes obsolete. Examples of assets that should use the double declining methods are computer equipment, expensive cell phones and other technology that has more value the beginning of its life than the end.

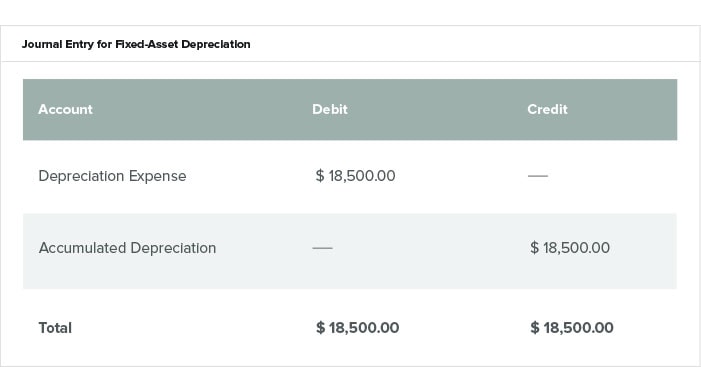

Journal Entries for Fixed-Asset Depreciation

Depreciation is a significant cost-saving function. Depreciation provides an approximate current value and allows you to spread the cost of an asset over its useful life

Salvage Value in Depreciation Calculations

When an organisation anticipates that it can sell an asset or that an asset will otherwise provide value disposal, that amount represents the salvage value. You deduct the salvage value from the initial cost to determine the amount that will be depreciated through the service life of the asset.

Here is the formula to calculate salvage value:

Value estimates may not be consistent, and they can and should be adjusted throughout the life of an asset.

If a company buys an asset for $5000 and expects to sell it for $1000 in three years, it can then depreciate $4000. At the end of three years, the company expects to sell the asset for $1000.

Below are the formulas for each type of depreciation.

Straight-Line Depreciation

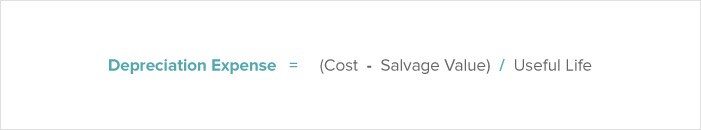

To record straight-line depreciation, debit the asset depreciation expense account and credit the accumulated depreciation account. Here is the formula:

For example, a company determines that its monthly depreciation expense is $18,500. It enters the information as shown below.

Accelerated or Sum of Remaining Years Depreciation

This method of calculating depreciation assumes that the asset productivity decreases over time. Here is the formula:

For example, a manufacturing company purchases a machine on Dec. 1, 2022 for $56,000. The company expects that machine to be useful for three years. The salvage value is $3,000.

The schedule for this depreciation looks like this:

Calculate the figures in the schedule as follows:

- The depreciable base = $56,000 - $3,000 = $53,000The remaining life is how many years from the purchase year you assume are left.The depreciation fraction designates the sum of the number of years of remaining life as the denominator. In this case, it is 1 + 2 + 3 = 6. The numerator is the remaining life.The Depreciation Expense = (the Depreciation Expense) x (the Depreciation Fraction). For the first year, this is $53,000 x 3/6 = $26,500.The book value for the machine = $56,000 - $26,500 = $29,500.

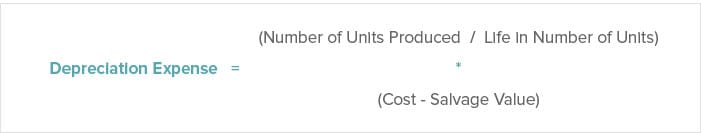

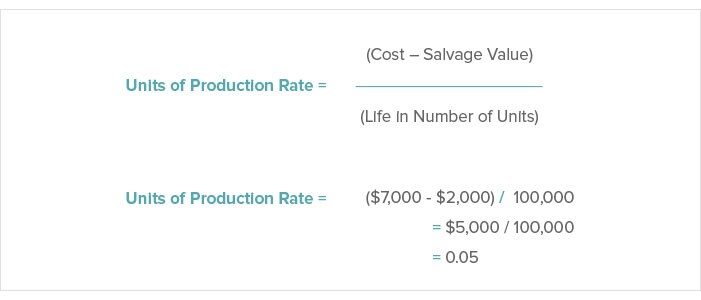

Units of Production Depreciation

This method evaluates depreciation based on how much an asset is used. In a period during which the asset has more usage, a company may charge more depreciation. When the asset doesn’t have as much usage, a company will charge less usage. Here is the formula:

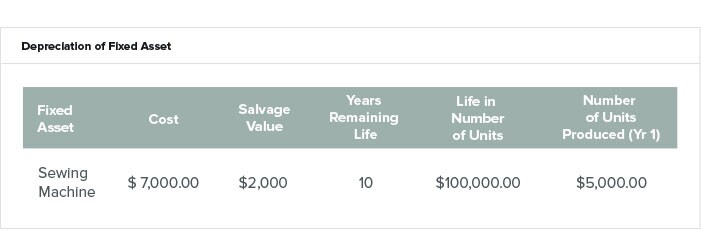

For example, a company that specialises in tailoring garments purchases a new sewing machine. The company will charge depreciation based on how much it uses the new machine. The information for this calculation is in the table below:

First, calculate the rate of units of production. This is:

From this formula above, calculate the depreciation expense. This is the practical use for the rate of depreciation that companies use on taxes. Accountants can apply the rate and number of units produced to every successive year the company uses the machine in order to calculate the tax write-off amount. For the first year, this is

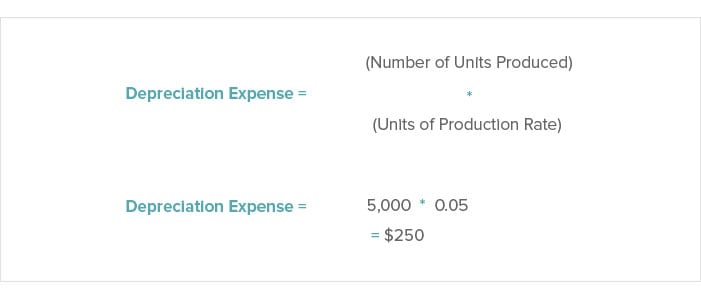

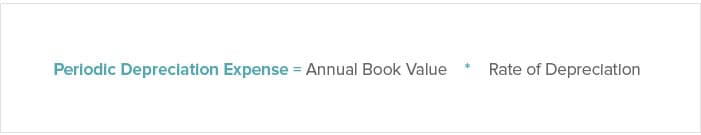

Double Declining Balance Depreciation

Companies use an accelerated depreciation method to account for the expense of long-lived assets. Companies recognise most of the depreciation for these assets in the first few years of their useful life, with smaller amounts of depreciation in later years. Note that the basis for depreciation changes each year. According to Adams: “The balance will asymptotically approach $0 but never get there. Since the balance adjusts each year, the asset will never be fully depreciated under the DDB system. Most companies opt to switch from DDB to SL depreciation when it becomes more advantageous to do so.” Here is the formula:

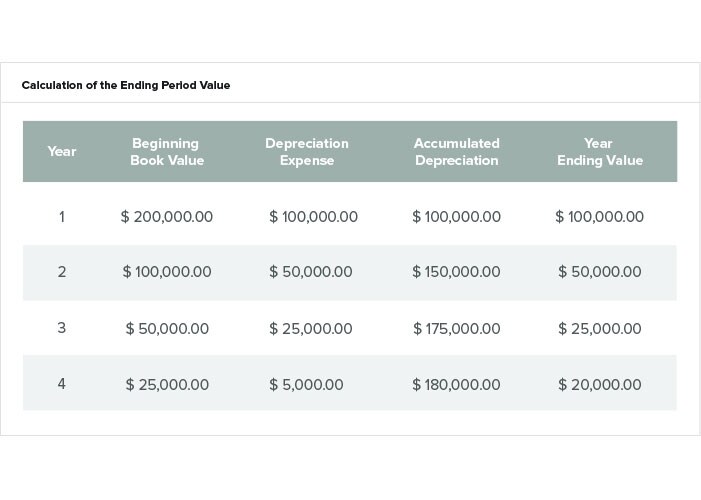

In example 1, a $100,000 asset with a four-year life and $10,000 salvage value, the following year-by-year breakdown shows the depreciation.

Assume the straight-line depreciation is $22,500.

In example 2, the company shows the depreciation of a $200,000 asset with a useful life of four years with a salvage value of $20,000. The company does not subtract the salvage value from the base. The assumptions for this:

- The total depreciable amount for the life of the asset is $180,000 ($200,000 - $20,000).The annual SL depreciation rate is 25% (100%/4 years). The DDB rate is 50%.The beginning period book value is $100,000 ($200,000 x 50%).The chart below shows the calculation of the ending period value.

Depreciation stops when the accumulated depreciation reaches the amount of the depreciable base.

Depreciation and Tax Deductions

Depreciation spreads the cost of an asset over its service life. By reducing the taxable earnings, depreciation reduces the amount of taxes owed. For the purpose of tax deductions, an asset’s service life may be different than its depreciation life.

Depreciation for tax purposes focuses on offering a faster tax write-off, whereas depreciation for accounting purposes helps to match revenue with expense.

What Is the Accounting Treatment for the Revaluation of Fixed Assets?

The revaluation of fixed assets helps to reflect the fair market value of volatile assets or changes to the usefulness of an asset. Revaluation analysis describes the carrying value, or book value, of the asset, or its value through its life. Although carrying value usually decreases over time, under International Accounting Standard (IAS) 16, you can revalue some assets so that the carrying value increases.

Since values for some assets change frequently, revaluation can happen as often as once a year. More commonly, revaluations occur every 3-5 years. However, you cannot revalue a fully depreciated asset.

Revaluation: Valuation Models for Fixed Assets

After the purchase of an asset, measure valuation when you need to understand the value of your asset before you sell it, solicit investments, anticipate a merger or acquisition, require a loan, prepare a financial report or conduct an audit. Here are two models:

- Cost: In this model, subtract the accumulated depreciation and any impairment costs from the original cost price.Revaluation: Under IAS 16, subtract the accumulated depreciation and impairment costs from the current fair market value.

Performing Impairment Testing

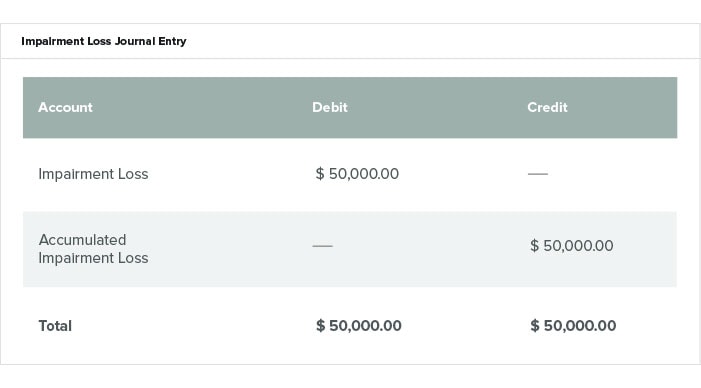

Asset impairment is akin to an advanced depreciation, which is when you reduce the potential benefit from an asset. When fixed assets undergo a significant change in circumstance that may reduce their gross future cash flow to an amount below their carrying value, apply an impairment test. The impairment may apply to one asset or a group of assets. Below is an impairment journal entry when the loss is $50,000.

Impairment Loss Journal Entry

Changes to the status of an individual asset do not signal impairment, and, frequently, only the estimated service life needs adjusting. These scenarios and similar circumstances may prompt impairment testing. Significant deterioration in an asset’s condition, a history of operating losses that suggest a future pattern or a significant drop in the asset’s market price are all scenarios that might require impairment testing. For example, a 30-year-old, coal-fired power plant is nearing retirement age and a new regulation appears, requiring millions of dollars in updates. A cost-benefit analysis may show that the investment in an ageing plant that’s soon to be taken offline is not worthwhile. If you cannot continue to operate the plant, you would write off the remaining value of the asset, impair the asset value and write it off on your books. If the useful life of the asset or its value changes, it is classified as an impaired asset.

Accounting for Disposal of Fixed Assets

Asset disposal requires that the asset be removed from the balance sheet. Disposal indicates that the asset will yield no further benefits. Depending on the value of the asset, a company may need to record gain or loss for the reporting period during which the asset is disposed.

Journal Entry for Gain on Disposal

Gain on disposal is calculated by subtracting the accumulated depreciation from the original cost of an asset and then adding the sales amount. In this example, the asset was purchased for $100,000, and accumulated depreciation is $80,000. A buyer paid $54,000 cash for the asset, which results in a gain on disposal of $34,000.

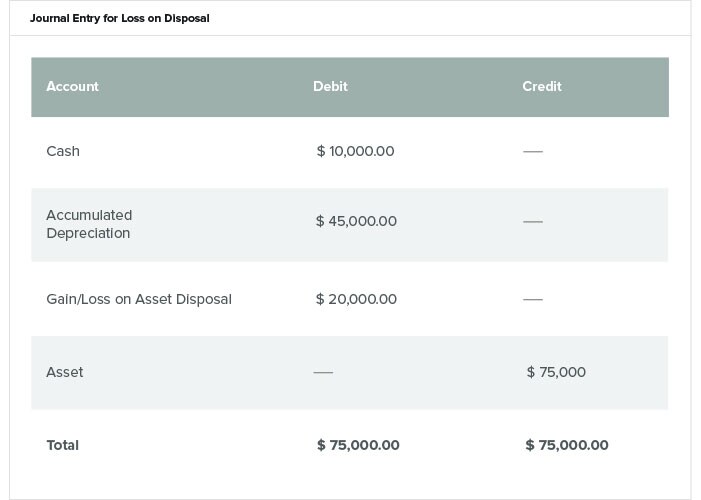

Journal Entry for Loss on Disposal

To calculate the loss on disposal of an asset, subtract the accumulated depreciation from the original cost, and then subtract the sales price. In the example below, accumulated depreciation is $45,000; the original cost of the asset is $75,000; and the sales price is $10,000. After depreciation, a loss of $20,000 is recognised on the disposal of the asset.

Fixed-Asset Accounting Best Practices

“For your business, the key is understanding the distinction between the capitalisable costs and those that should be immediately expensed. These costs vary business by business. But broadly, if the cost you’re incurring is material and it is necessary to extend an asset’s useful life beyond one year, then that is a cost that should be capitalised,” advises Adams.

Consider these useful tips when recording and tracking fixed assets:

Always:

- Consider asset impairment when significant events or changes in circumstances occur.Tag assets for easy tracking. Asset tags allow organisations to track equipment and other assets through their lifecycle to ensure maintenance and prevent loss. Basic tags can include QR, barcodes or serial numbers and organisation contact information. On computer equipment, organisations frequently use the manufacturer’s serial number or universally unique identifier (UUID) for asset tracking. Tracking with traditional labels requires staff to physically contact the label with a scanning device or record the numbers on paper. Today, companies often monitor critical and high-cost assets with radio frequency identification (RFID) tags. Tag materials range from vinyl for minimum endurance, through polyester, to surface printed aluminium and subsurface printed aluminium for high endurance scenarios.Review estimates of useful lives regularly.Make sure your key assets are covered by insurance, and keep detailed records in case an insurance claim needs to be filed.If an asset can return some gain the end of its service life, determine the depreciation on cost minus the estimated salvage value.Capitalise assets where the cost is material and the useful life is greater than 12 months.When recording a fixed asset, include all expenditures to acquire, ship and install the asset. These costs become part of the capitalised cost of the asset.If your organisation builds an asset and you borrowed money to pay for the work, the cost comprises all components, including materials, labour, overhead and any interest expense. Capitalise any additions you made to extend the service life or capability of the asset.The board of directors or senior managers of an organisation should create a capitalisation policy with a dollar amount threshold. Expense any assets that cost less than the threshold.

Never:

- Expense the costs associated with purchasing a fixed asset.Confuse tax-based depreciation with GAAP-based depreciation.Disregard significant changes in circumstances for an asset, as it may be subject to impairment.Depreciate a leased asset over its service life without considering the asset’s proper life.Forget insurance recordkeeping requirements when recording and tracking fixed assets.

Special Cases in Fixed-Asset Accounting and How to Handle Them

Every accounting speciality has unique considerations. Fixed assets usually form a substantial investment for an organisation, and each asset can include many components requiring special attention.

When to Record Software and Associated Costs as Fixed Assets

In accounting, software for internal use is treated differently from software purchased or developed to sell to others.

In general, capitalise the following:

- Amounts paid to a third party for purchase or developmentFees for installation and testing of hardwareInternal or external travel, payroll and contracting expenses that are related to development or installationInterest costs related to financing a software purchaseFor cloud-based implementations, costs are amortised over the life of the service contract on a straight-line basis

Expense the following:

- Costs to research and shop for the purchase of softwareFees for software training and maintenanceCosts for upgrades and additions. If upgrades and enhancements increase functionality, capitalise the costs.Charges for the process of converting old data

Software for External Sales:

The developer creating a software product to sell has limited capitalisation opportunities. No asset exists in the initial planning and R&D stages, so you must expense costs. During product development, expense costs spent directly towards creating product. Capitalise only the cost of development and test team salaries and other costs spent directly on the product. After the product launch, expense maintenance costs.

Handling Leasing Fixed Assets

Not all fixed assets are purchased directly. Sometimes, companies lease large machinery that has a minimal chance of becoming obsolete. In a capital lease, the lessee assumes all the responsibilities of an owner and treats payments on a long-term lease as fixed-asset payments. The asset can depreciate and be treated as a debt. By keeping the liability off the balance sheet, a company can present a false impression of financial robustness. For this reason, the new ASC 842 and IFRS 16 standards require public and private companies to update their leased fixed asset recording practices to ensure that records reflect true asset turnover rates and profits and earnings. The new standards present far reaching implications for reporting and financial and contractual obligations. Learn more about preparing for these changes by reading “Lease Accounting 101—A Roadmap to ASC 842 & IFRS 16.”

How to Deal with Fixed-Asset Accounting for an Insurance Claim

When you place an insurance claim on fixed assets, you must take certain accounting steps. Remove the asset from your books, but record the payout as a proceed. You can record the transaction when payment is possible or when you receive it. The best practice is to record the payout when you receive it. Proceeds may cover only the fair market value of the asset. If the insurance policy carries a coinsurance clause, you are required to carry insurance to cover least 60% of the asset’s fair market value.

“When you are expecting an insurance payout, or, conversely, when you are liable, you must account for the liability or accrue the revenue on your balance sheet if an insurance action is probable or likely,” Adams says.

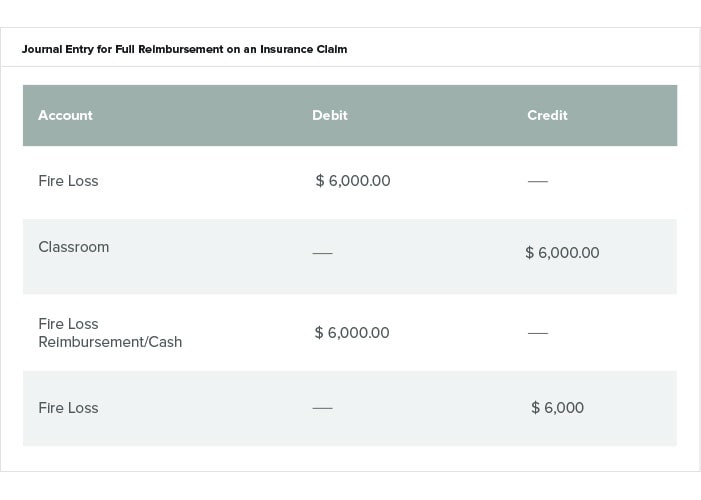

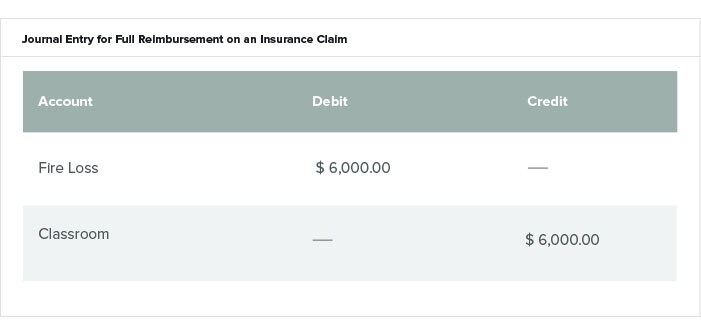

Full Reimbursement on an Insurance Claim

If you receive a full payout, record the proceeds and the full value of the loss. However, you still must zero out the total of the loss on your books. For example, if you own an art store and your $6,000 classroom is totalled in a fire and the payout covers the full amount, then the entry would be:

No Payout from Insurance Company

If your insurance does not reimburse the loss, enter the dollar amount of the damage, and reduce or write off the asset.

Gain or Loss

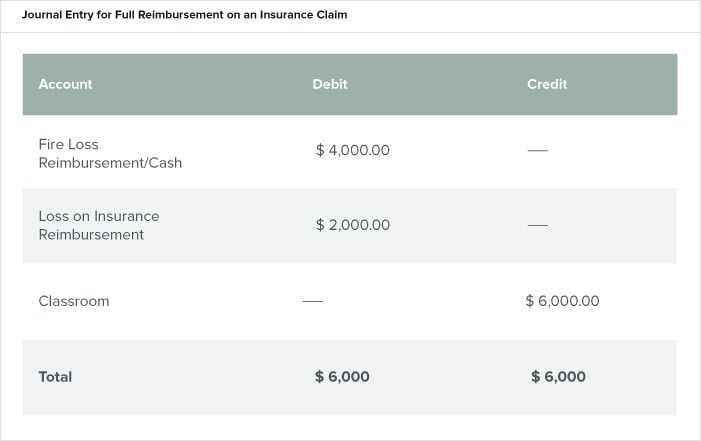

You may record a loss on your insurance payout. For example, if insurance pays $4,000, record a loss (debit) of $2,000.

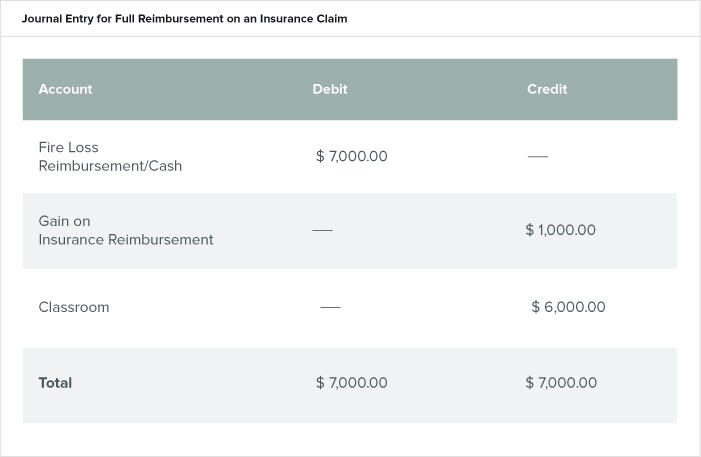

You may also record a gain. For example, if a fire destroyed the same $6,000 classroom but the payout was $7,000, you have a gain in proceeds of $1,000.

Fixed-Asset Accounting FAQ

Below are the most frequently asked questions concerning fixed asset accounting, as well as the concise, clear answers you’re seeking.

What Is a Fixed-Asset Accountant?

A fixed-asset accountant is usually a certified public accountant (CPA) who specialises in the correct accounting of a company’s fixed assets. Fixed-asset accountants often work with other accounting roles to calculate asset depreciation. They also ensure that accounting departments record and track assets correctly as well as handle tax accounting requirements for fixed assets.

What Is Component Accounting for Fixed Assets?

Component accounting or component depreciation assigns different costs to different parts of a large property, plant or equipment asset. Since these components wear out varying rates and have different salvage values, each component depreciates separately.

How Do You Handle Accounting for Deposits on Fixed Assets?

Suppose you are buying an asset through instalments or loan payments and you make a deposit. If a fixed-asset account does not already exist, you need to create one. Then, post any payments to the account on the dates you made them. You’ll also want to create a liability record for the loan and record the loan as a debt. If the organisation has not yet received the asset, it is still a current asset, not a fixed asset. In this case, only the deposit is an asset.

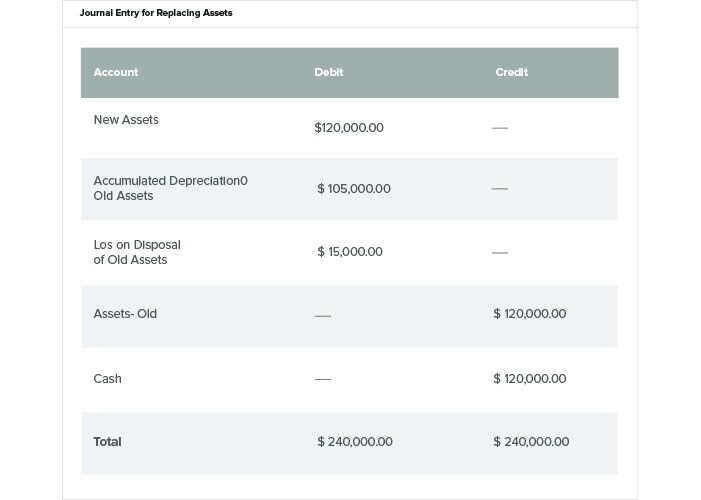

How Do You Handle Accounting for Replacing Assets?

Calculate replacement cost by subtracting the accumulated depreciation from the asset value listed on the balance sheet. When reviewing a company’s balance sheet, you can detect which assets may soon require replacement by looking for assets with a high accumulated depreciation. For journal entries, use a substitution approach. For example, a manufacturing company replaces some machinery for $120,000. The net book value of these assets is $15,000, which is the net value minus the accumulated depreciation of the old assets ($120,000 - $105,000). The journal entry would look like the following:

What Are Fixed-Asset Clearing Accounts?

Clearing accounts provide temporary holding places for cash totals. Rather than requiring an accounts payable clerk to know each specific destination account, this method allows them to work from the clearing account. The balance is usually 0.00 because the clearing account gets credited and the fixed-asset account is debited the same amount.

Use clearing accounts when you cannot immediately post payments to a permanent account. For example, if you are furnishing a new building for a client, you may place costs and payments in a clearing account until the work is complete. If checks must clear and you have the cash to deposit in the bank , you may add the amounts to a clearing account.

NetSuite’s Fixed-Asset Accounting System for Improved Asset Visibility

Dedicated fixed-asset accounting software can calculate depreciation and record other relevant details. Online platforms remove the burden of multiple manual entries, improve reporting and facilitate audit trails. Additionally, fixed-asset accounting systems can track assets to guard against theft.

Business owners know that maintaining complete and up-to-date fixed-asset records isn’t easy. What’s more, if you are preparing for any audit, fixed-asset management accounting can be quite daunting. That’s why it’s essential to have the right tools to help you monitor fixed assets throughout their useful lives. NetSuite’s financial management solution provides real-time visibility into all of your company’s fixed assets and expedites financial transactions.

Are items owned by a business that will provide future benefits?

Assets are the items your company owns that can provide future economic benefit. Liabilities are what you owe other parties.Which of the following terms refers to any economic resource that is expected to benefit a firm or individual who owns it?

Asset. A resource with economic value that an individual, corporation, or country owns with the expectation that it will provide future benefits.What are asset examples?

Examples of Assets. Cash and cash equivalents.. Accounts receivable (AR). Marketable securities.. Trademarks.. Patents.. Product designs.. Distribution rights.. Buildings..Is cash an asset or equity?

In short, yes—cash is a current asset and is the first line-item on a company's balance sheet. Cash is the most liquid type of asset and can be used to easily purchase other assets. Tải thêm tài liệu liên quan đến nội dung bài viết Is/are the resources from which a company expects to gain some future benefit